راهنمای بین المللی ریسک کشوری ICRG چیست؟

International Country Risk Guide

ICRG از سال 1980 بصورت ماهانه داده هایی را منتشر می کند و مشتریان بین المللی را با رتبه بندی هایی که بر ریسک سیاسی، ریسک اقتصادی و ریسک مالی جهانی خود در 140 بازار توسعه یافته، در حال ظهور و مرزی تأثیر می گذارد، فراهم کرده است. تشکیل سیستم مبتنی بر هشدار اولیه، بیش از 30 معیار برای ارزیابی این انواع ریسک استفاده می شود. متدولوژی ICRG به طور مداوم توسط محققان در صندوق بین المللی پول مورد استفاده قرار گرفته است و در چنین نشریاتی از جمله Barron، The Economist و The Wall Street Journal تحسین شده است.

هزینه فایل اکسل

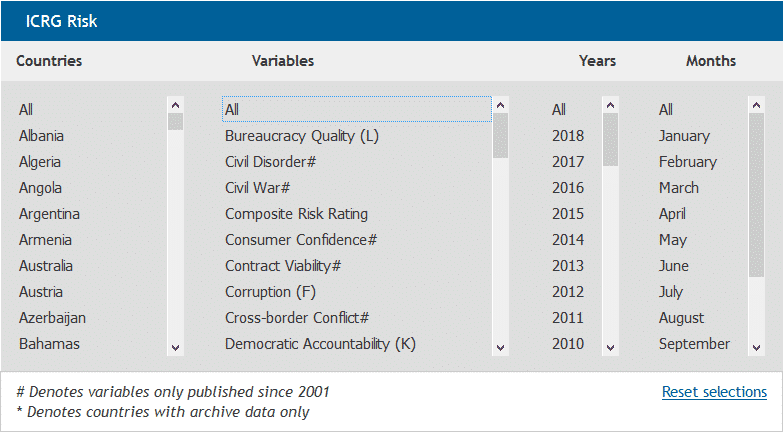

فایل شماره اول یعنی ICRG Risk در فرمت اکسل با هزینه 129 هزار تومان ارسال می شود. این داده ها تا تاریخ 30-Jan-2020 بروز می باشد.

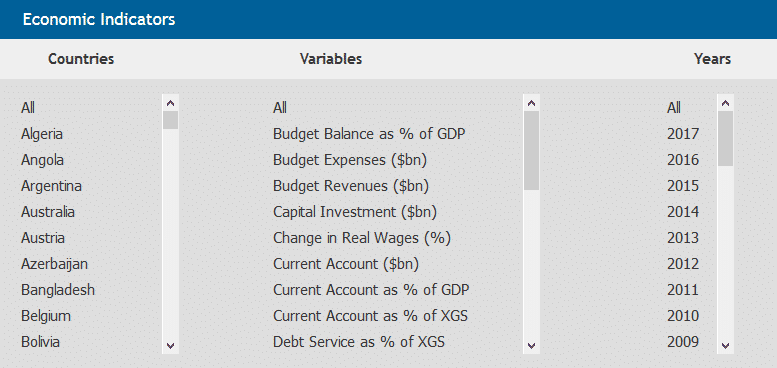

فایل شماره دوم یعنی Economic indicators در فرمت اکسل با هزینه 45 هزار تومان

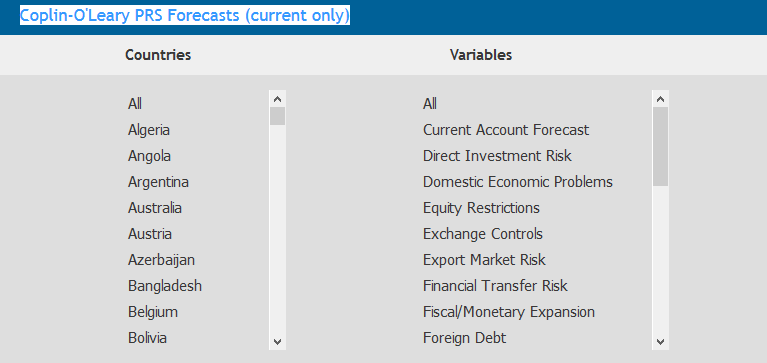

فایل شماره سوم یعنی Coplin-O’Leary PRS Forecasts در فرمت XLSX با هزینه 45 هزار ت

هزینه هر سه فایل با 199 هزار ت

پس از واریز هزینه به یکی از حسابهای سایت، از طریق یکی از راه های ارتباطی (تلگرام، واتس اپ 09035556564، ایمیل) اطلاع دهید تا فایلهای اکسل ارسال شود.

تهیه امار از Bankscope ، World Bank و ICRG

معرفی International Country Risk Guide

International Country Risk Guide

Alternative Titles : ICRG

Description : Four datasets from the International Country Risk Guide comparing political, financial and economic risk for countries worldwide for the period 1984-2022:

Table 2B Composite Risk Ratings, Table 3B Political Risk Points by Component, Table 4B Financial Risk Points by Component, Table 5B Economic Risk Points by Component.

Data sets can be downloaded to Excel.

Type : Numeric Data

Coverage : 1984-2022

More Information : ICRG Methodology

Subjects : Government, Politics & Law

Political Science

Statistics and Data Sets

Statistical (Macro-Level) Data

Social Sciences

Statistics and Data Sets

Statistical (Macro-Level) Data

تهیه امارهای ICRG | داده های راهنمای بین المللی ریسک کشوری

می توانید داده های سایت prsgroup.com را از کشورهای مختلف ( اعم از ایران ، امریکا عراق و …) در قالب CSV و یا XLS (فرمت اکسل) از ما درخواست کنید. داده ها از سال 1984 تا امروز (بروزترین سال موجود) قابل تهیه است.

درخواست نیاز به آمارهای ICRG را از طریق یکی از راههای ارتباطی برای ما ارسال کنید.

![]()

![]()

![]()

![]()

![]()

![]()

دانلود داده های راهنمای بین المللی ریسک کشوری 2022 ICRG

پس از خرید فایلها با ویژگیهای زیر ارسال می شود

1- داده ها در فرمت اکسل ذخیره شده اند.

2- داده ها سالانه بوده و شامل بازه 1984 تا 2022 هستند.

3- محصول شامل جدول Researchers Dataset (ICRG Table 3B – Political Risk) است و متغیرهای های توضیح داده شده در ادامه را برای 146 کشور جهان (ازجمله ایران) در بر می گیرد.

متدولوژی International Country Risk Guide

International Country Risk Guide Methodology

The International Country Risk Guide (ICRG) rating comprises 22 variables in three

subcategories of risk: political, financial, and economic. A separate index is created for each of

the subcategories. The Political Risk index is based on 100 points, Financial Risk on 50 points,

and Economic Risk on 50 points. The total points from the three indices are divided by two to

produce the weights for inclusion in the composite country risk score. The composite scores,

ranging from zero to 100, are then broken into categories from Very Low Risk (80 to 100 points)

to Very High Risk (zero to 49.9 points).

international country risk guide 2022

The Political Risk Rating includes 12 weighted variables covering both political and social

attributes. ICRG advises users on means of adapting both the data and the weights in order to

focus the rating on the needs of the particular investing firm.

ICRG incorporates a “Type II” forecast (see Chapter 1, Introduction, of PRS textbook The

Handbook of Country and Political Risk Analysis) in which its experts provide a current

assessment, a one-year assessment, and a five-year assessment. The projections of future

conditions are framed in “best” case and “worst” case scenarios. This provides managers with a

probabilistic future in which to make judgments about risk management or insurance needs.

Country analyses in ICRG include descriptive assessments and economic data (listed on this site

under “Historical Analyses”). ICRG provides ratings for 140 countries on a monthly basis, and

for an additional 26 countries on an annual basis under a different title.

—Llewellyn D. Howell, Ph.D

فایل انگلیسی متدولوژی ICRG

متغیرهای مختلف که داده های ICRG براساس ان گزارش داده می شود :

The PRS Group Guide to Data Variables

Variable Name | Definition |

|---|---|

Administrative Subdivisions | Number and type of administrative districts in the country. |

Agricultural Work Force | Percentage of the work force employed in agricultural production. |

Area | Total area of the country in square kilometers. |

Budget Balance as % of GDP | Central government budget balance for a given year, expressed as a percentage of GDP. |

Budget Expenses ($bn) | Nonrepayable and nonrepaying payments by governments, plus government acquisition of claims on others (loans and equities), less repayments of lending and sales of equities previously purchased. |

Budget Revenues ($bn) | Nonrepayable and nonrepaying government receipts, plus grants received from other governments (domestic or foreign) and international institutions. |

Bureaucracy Quality (L) | Institutional strength and quality of the bureaucracy is a shock absorber that tends to minimize revisions of policy when governments change. In low-risk countries, the bureaucracy is somewhat autonomous from political pressure. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Capital | Designated seat of government of the country. |

Capital Investment ($bn) | Annual value of gross fixed capital formation. |

Change in Real Wages (%) | Annual percent change in real wages. |

Civil Disorder | The potential risk to governance or investment from mass protest, such as anti-government demonstrations, strikes, etc. |

Civil War | The actual or potential risk of civil war (where a rebel force, which holds territory, is in armed conflict with the security forces of the government, and where both forces are citizens of the state in which the conflict occurs). |

Commentary on Elections | National election schedule and terms of office; the date of the most recent election; and the date of the next election or the date by which the next election must be held, as appropriate. |

Composite Risk Rating | Composite Political, Financial, Economic Risk Rating for a country (CPFER) = 0.5 ( (Political Risk + Financial Risk + Economic Risk) Ranging from Very High Risk (00.0 – 49.5) to Very Low Risk (80.0 – 100). The higher the points, the lower the risk. |

Constitution | Date of promulgation of the country’s current constitution. |

Consumer Confidence | The level of consumer confidence vis-à-vis credible surveys, where available, or approximations based on employment trends, economic growth and investment, etc. |

Contract Viability | The risk of unilateral contract modification or cancellation and, at worst, outright expropriation of foreign owned assets. |

Corruption (F) | A measure of corruption within the political system that is a threat to foreign investment by distorting the economic and financial environment, reducing the efficiency of government and business by enabling people to assume positions of power through patronage rather than ability, and introducing inherent instability into the political process. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Country Name | COUNTRY NAME |

Cross-border Conflict | Actual or potential conflict with another nation state that does not affect the whole nation and which can range in severity from cross-border armed conflict and incursion to territorial claims subject to civil mediation or litigation. |

Currency Change | Annual percent change in the national currency value in relation to the USD; for the USD, the value in relation to the EUR (prior to 2000, to the DM). |

Current Account ($bn) | Total balance of payments on goods and services and all transfer payments: the difference between (a) exports of goods and services, plus inflows of unrequited official and private transfers, and (b) imports of goods and services, plus unrequited transfers to the rest of the world. |

Current Account as % of GDP | Balance on the current account of the balance of payments expressed as a percentage of GDP. |

Current Account as % of XGS | Balance on the current account of the balance of payments expressed as percentage of total exports of goods & services (XGS). |

Current Account Forecast | Forecast of Current Account average for next year and for subsequent five-year period. |

Debt Service as % of XGS | Foreign debt service expressed as a percentage of the sum of estimated total exports of goods and services. |

Debt Service Ratio | Year’s sum of interest and principal repayments on external public and publicly guaranteed debt as a percentage of XGS. |

Democratic Accountability (K) | A measure of, not just whether there are free and fair elections, but how responsive government is to its people. The less responsive it is, the more likely it will fall. Even democratically elected governments can delude themselves into thinking they know what is best for the people, regardless of clear indications to the contrary from the people. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Direct Investment Risk | Ratings of risk to foreign investment in wholly owned subsidiaries, joint ventures, and other forms of direct asset ownership. Risk ratings for 18-month and five-year forecast periods, expressed both as alpha grades and as numerical scores, ranging from the least risk at A+ (<0.25) to the most risk at D- (>2.75). Also included are the previous alpha grades for both forecast periods. |

Domestic Economic Problems | ۵-year risk variable that takes into account such economic factors as GDP per capita, real GDP growth, inflation, budget balance as % of GDP, unemployment and capital investment as % GDP. |

Economic Risk Rating | A means of assessing a country’s current economic strengths and weaknesses. In general, where strengths outweigh weaknesses, a country will show low risk and where weaknesses outweigh strengths, the economic risk will be high. To ensure comparability between countries, risk components are based on accepted ratios between the measured data within the national economic/financial structure, and then the ratios are compared, not the data. Risk points are assessed for each of the component factors of GDP per head of population, real annual GDP growth, annual inflation rate, budget balance as a percentage of GDP, and current account balance as a percentage of GDP. Risk ratings range from a high of 50 (least risk) to a low of 0 (highest risk), though lowest de facto ratings are generally near 15. |

Election after Next | Plan and timing for election after next. |

Energy Consumption | The amount of primary energy consumed per person in trillion BTU. |

Energy Consumption Per Head | The amount of primary energy consumed in quadrillion BTU. |

Equity Restrictions | ۱۸-month risk variable that takes into account policies and motivations related to equity ownership, including any requirements for national participation or prohibitions against equity ownership that might exist now and in the forecast period, including underlying factors and considerations for international investors. |

Ethnic Groups | Ethnics groups with which significant percentages of the population identify themselves. |

Ethnic Tensions (J) | A measure of the degree of tension attributable to racial, national, or language divisions. Lower ratings (higher risk) are given to countries where tensions are high because opposing groups are intolerant and unwilling to compromise. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Exchange Controls | ۱۸-month risk variable that takes into account controls on currency exchange affecting international business operations and the movement of international funds and funding. |

Exchange Rate | Currency value in relation to the US dollar (or euro for US dollar; prior to 2000, to the deutschmark) and applicable date. |

Exchange Rate (Local) | Average currency value in relation to the USD; for the USD, the value in relation to the EUR (prior to 2000, to the DM). |

Exchange Rate Stability | Annual percentage change in the exchange rate of the national currency against the USD (against the EUR in the case of the USD; prior to 2000, to the DM). |

Exchange System | Description of the exchange characteristics of the currency. |

Export Market Risk | Ratings of risk faced by exporters to the country, especially risks related to market conditions, barriers to imports, and delays or difficulties in receiving payment for goods. Risk ratings for 18-month and five-year forecast periods, expressed both as alpha grades and as numerical scores, ranging from the least risk at A+ (<0.25) to the most risk at D- (>2.75). Also included are the previous alpha grades for both forecast periods. |

Exports ($bn) | Year’s value of merchandise exports, measured free-on-board. |

External Conflict (E) | A measure of both the risk to the incumbent government from foreign action, ranging from non-violent external pressure (diplomatic pressures, withholding of aid, trade restrictions, territorial disputes, sanctions, etc) to violent external pressure (cross-border conflicts to all-out war). The risk rating assigned is the sum of three subcomponents: War, Cross-Border Conflict, and Foreign Pressures.(Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Financial Risk Rating | A means of assessing a country’s ability to pay its way by financing its official, commercial and trade debt obligations. To ensure comparability between countries, risk components are based on accepted ratios between the measured data within the national economic/financial structure, and then the ratios are compared, not the data. Risk points are assessed for each of the component factors of foreign debt as a percentage of GDP, foreign debt service as a percentage of exports of goods and services (XGS), current account as a percentage of XGS, net liquidity as months of import cover, and exchange rate stability. Risk ratings range from a high of 50 (least risk) to a low of 0 (highest risk), though lowest de facto ratings are generally near 20. |

Financial Transfer Risk | Ratings of risk from financial transfer, nonconvertibility from the local currency to the desired foreign currency, and the transfer of foreign currency out of the country. The transfer could be for the payment of exports, repatriation of profits, capital or dividends. Risk ratings for 18-month and five-year forecast periods, expressed both as alpha grades and as numerical scores, ranging from the least risk at A+ (<0.25) to the most risk at D- (>2.75). Also included are the previous alpha grades for both forecast periods. |

Fiscal/Monetary Expansion | ۱۸-month risk variable that takes into account fiscal and monetary policies, expansionist tendencies, current policies and those likely to be pursued by three alternative regime scenarios, especially deficit spending and control over credit, including such factors as recent trends in inflation and economic growth. |

Foreign Debt | ۱۸-month risk variable that takes into account the country’s borrowing practices, need for borrowing, attitudes toward borrowing and the willingness of public and private international sources to provide funds. Commentary includes a discussion of policies and attitudes likely under the three alternative regime scenarios during the forecast period, and might also cover aid from other countries and from international financial institutions. |

Foreign Debt as % GDP | Gross foreign debt expressed as a percentage of GDP. |

Foreign Direct Investment ($bn) | One year’s investment by foreign entities or citizens in domestic business. |

Foreign Pressures | Actual or potential risk posed by pressures brought to bear on the government by one or more foreign states to force a change of policy. Such pressures can range from diplomatic pressures, through suspension of aid and/or credits, to outright sanctions. |

Forex Reserves ($bn) | Year-end value of foreign currency holdings (excluding gold) retained by the central bank for purposes of exchange intervention or settlement of intergovernmental claims. |

Freedom of the Press | Rating (0-3, least to most control), and information about the level and characteristics of government control of the press. |

GDP (Nominal, $bn) | Nominal value of the total final output of goods and services produced within a country’s territorial jurisdiction, regardless of the foreign or domestic ownership of the source of the production. |

Government Cohesion | The extent to which the executive/cabinet is coalesced around the government’s general policy goals. |

Government in Economy | Sectors of the economy in which the government exercises control or ownership. |

Government Officials & their Posts | Listing of major government officials. Priority is given to the following: de facto leader of the country (where applicable), Deputy Prime Minister, Agriculture, Commerce, Defense, Development, Energy, Finance, Foreign Affairs, Industry, Interior, Labor. |

Government Stability (A) | A measure of both of the government’s ability to carry out its declared program(s), and its ability to stay in office. The risk rating assigned is the sum of three subcomponents: Government Unity, Legislative Strength, and Popular Support.(Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Head of Government | Administrative leader of the government, and the year of accession. |

Head of State | Formal leader of the country, and the year of the leader’s accession. |

Imports ($bn) | Year’s value of merchandise imports, measured fob. |

Industrial Work Force | Percentage of the work force employed in industrial production and commerce. |

Infant Deaths | Infant deaths per 1,000 live births. |

Inflation (%) | Annual average percent change in the consumer price index. |

Inflation Forecast | Forecast of Inflation average for next year and for subsequent five-year period. |

Int’l Liquidity (months import cover) | Annual net liquidity expressed as months of import cover and calculated as the official reserves of the individual countries, including their official gold reserves calculated at current free market prices, but excluding the use of IMF credits and the foreign liabilities of the monetary authorities. |

Internal Conflict (D) | A measure of political violence in the country and its actual or potential impact on governance. The risk rating assigned is the sum of three subcomponents: Civil War/Coup Threat, Terrorism/Political Violence, and Civil Disorder. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

International Economic Problems | ۵-year risk variable that takes into account such economic factors as current account, GDP per capita, debt service, and currency exchange rates. |

Investment Profile (C) | A measure of the factors affecting the risk to investment that are not covered by other political, economic and financial risk components. The risk rating assigned is the sum of three subcomponents: Contract Viability/Expropriation, Profits Repatriation, and Payment Delays. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Investment Restrictions | ۵-year risk variable that takes into account policies and potential policies under three regime scenarios that do or could affect direct foreign investment by wholly owned subsidiaries, joint ventures, and other forms of direct asset ownership, factoring in the political support and opposition of key political actors. |

Labor Costs | ۱۸-month risk variable that takes into account the direct personnel cost of producing goods and services — government policies and restrictions, pressures from labor, and attitudes of business toward wage increases — at the time of publication and over the forecast periods. |

Languages | Languages spoken by the population of the country. |

Law & Order (I) | Two measures comprising one risk component. Each sub-component equals half of the total. The “law” sub-component assesses the strength and impartiality of the legal system, and the “order” sub-component assesses popular observance of the law. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Legislative Strength | Whether the government can realize its policy program through the legislative arm of government. |

Legislature | Types of national legislative bodies and the distribution of seats among the major political parties. |

Literacy | Percentage of persons aged 15 years and over who can read and write. |

Local Operations Restrictions | ۱۸-month risk variable that takes into account restrictions on procurement and restrictions on labor or management personnel for international business operations. |

Military in Politics (G) | A measure of the military’s involvement in politics. Since the military is not elected, involvement, even at a peripheral level, diminishes democratic accountability. Military involvement might stem from an external or internal threat, be symptomatic of underlying difficulties, or be a full-scale military takeover. Over the long term, a system of military government will almost certainly diminish effective governmental functioning, become corrupt, and create an uneasy environment for foreign businesses. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Money Supply (M1, $bn) | Year-end stock of money in the economy. Components of M1 include currency in circulation, commercial bank deposits, NOW accounts, credit union share drafts, mutual savings bank demand deposits, and nonbank travelers checks. |

Most Likely Regimes | Forecasts and probabilities of the three most likely regime scenarios in 18 months and five years. Probability scores for three regimes in each forecast period always total 100%. Primary differences in regimes include key personnel in the top policy-making positions, resulting from a purge, election, coup d’etat, reorganization, or high-level resignation. |

Next Election | Plan and timing for next election. |

Non-tariff Trade Barriers | ۱۸-month risk variable that takes into account government policies or the tendencies of key political actors policies or tendencies that might affect imports. These elements might include such factors as protectionist sentiment, licensing requirements, quotas, restricted or banned goods, as well as underlying factors, such as lack of foreign currency, nationalistic motivations, and employment problems, that could act as barriers to trade. |

Official Country Name | Official Name of Country. |

Official Language | Officially designated language(s) of the government. |

Payment Delays | ۱۸-month risk variable that takes into account factors affecting the timeliness or delays in payments to those exporting to the country, such as foreign exchange position, poor economic position, or formal and informal government policies and motivations. |

Payment Delays | The risk associated with receiving and exporting payments from the country (impediments include poor liquidity, exchange controls, an inadequate banking system, etc.) |

Per Capita GDP ($) | Ratio of nominal GDP to population. |

Per Capita GDP ($) | Ratio of nominal GDP to population. |

Political Actors | Key institutions, individuals and groups having an effect on the climate for international business in a country. A biography and background information appear in the Country Report, available from the publisher of this database. |

Political Risk Rating | A means of assessing the political stability of a country on a comparable basis with other countries by assessing risk points for each of the component factors of government stability, socioeconomic conditions, investment profile, internal conflict, external conflict, corruption, military in politics, religious tensions, law and order, ethnic tensions, democratic accountability, and bureaucracy quality. Risk ratings range from a high of 100 (least risk) to a low of 0 (highest risk), though lowest de facto ratings generally range in the 30s and 40s. |

Popular support | The level of support for the government and/or its leader, based on credible opinion polls. |

Population | Midyear estimate of the total number of people living in the country. |

Population Growth | Average annual percentage change in the population over the last five years. |

Poverty | The level of poverty vis-à-vis credible sources (e.g., IMF, World Bank, CIA Factbook) |

Principal Exports | Country’s primary exports and main export partners. |

Principal Imports | Country’s primary imports and main import partners. |

Real GDP Growth (%) | Annual change in estimated GDP at constant prices. |

Real GDP Growth Forecast (%) | Forecast of Real GDP Growth average for next year and for subsequent five-year period. |

Real GDP Growth Rate | Annual change in estimated GDP at constant prices. |

Religions | Religions observed by the population of the country. |

Religious Tensions (H) | A measure of religious tensions arising from the domination of society and/or governance by a single religious group — or a desire to dominate — in a way that replaces civil law by religious law, excludes other religions from the political/social processes, suppresses religious freedom or expressions of religious identity. The risks involved range from inexperienced people imposing inappropriate policies to civil dissent or civil war. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Repatriation | To what extent can profits be transferred out of the host country (impediments include exchange controls, excessive bureaucracy, a poor banking system, etc.) |

Repatriation Restrictions | ۱۸-month risk variable that takes into account restrictions, policies, and motivations related to the cross-border movement of profit, dividends, and capital by international business operations. |

Risk for Budget Balance | Ranging from high % of 4.0+ with risk points at 10.0, to a low of -30.0 with 0.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Current Account as % of GDP | Ranging from high % of 10.0+ with risk points at 15.0, to a low of -40.0 or below with 0.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Current Account as % of XGS | Ranging from high % of 25.0+ with risk points at 15.0, to a low of less than -120.0 with 0.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Debt Service | Ranging from high % of >85.0 with risk points at 0.0, to a low of 0.0 with 10.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Exchange Rate Stability | Ranging from high % change of either 0.0 – 9.9 appreciation or depreciation of 0.1-4.9 with risk points at 10.0, to a midpoint of either appreciation at 50.0+ or depreciation of 30.0 – 34.9 with risk points at 5.0 to a low depreciation of 100.0+ with 0.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Foreign Debt | Ranging from high % of >200.0 with risk points at 0.0, to a low of 0.0 with 10.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for GDP Growth | Risk points determined by expressing this number as a percentage of the average of the estimated total GDP of all the countries covered by ICRG, then assigning risk points, ranging from high % of 6+ with risk at 10.0, to a low of <0.4 with 5.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Inflation | Ranging from high % of 130+ with risk points at 0.0, to a low of 0.0 with 10.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for International Liquidity | Ranging from high % of 15.0+ with risk points at 5.0, to a low of 0.0 with 0.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Risk for Per Capita GDP | Risk points determined by expressing this number as a percentage of the average of the estimated total GDP of all the countries covered by ICRG, then assigning risk points ranging from high % of 250+ with risk at 5.0 points, to low of <10 with O.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Service Work Force | Percentage of the work force employed in service-oriented production. |

Socioeconomic Conditions (B) | A measure of the socioeconomic pressures at work in society that could constrain government action or fuel social dissatisfaction. The risk rating assigned is the sum of three subcomponents: Unemployment, Consumer Confidence, and Poverty.(Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) |

Tariff Barriers | ۱۸-month risk variable that takes into account government policies on imports, tariff levels and ranges, and underlying factors that relate to the levels of nationalism and protectionism. |

Taxation Discrimination | ۱۸-month risk variable that takes into account tax incentives and disincentives for direct foreign investment, including underlying economic factors that might affect positive and/or negative tax discrimination toward international business. |

Terrorism | The actual or potential risk of terrorism (where forces opposed to the government carry out violent acts against civilian or state targets to achieve a political goal). The fundamental difference between a terrorist campaign and a civil war is that the former do not hold and administer territory within a nation state. |

Total Foreign Debt ($bn) | The year-end value of gross indebtedness by private and public sector domestic borrowers to foreign entities. |

Trade Restrictions | ۵-year risk variable that takes into account tariff and non-tariff barriers to imports, including, as well as the political support or opposition of key political actors. |

Turmoil Ratings and Forecasts | Ratings of risk to international business people or property, as well as current level, 18-month forecasts of change under three regime scenarios, base level along with 5-year forecasts under three regime scenarios. Takes into account violence from political groups or foreign governments operating within a country or from an external base, including riots, politically motivated strikes (but not including legal, non-violent strikes), demonstrations, terrorism, guerrilla activities, and civil or international war. |

Unemployment | The official rate as defined by credible sources (e.g. IMF, World Bank, CIA Factbook); significant levels of underemployment or employment in the informal economy in emerging markets can affect the rating. |

Unemployment Rate (%) | Year’s average percentage of the labor force without work during the period. |

Unions | Percentage of the work force that belongs to labor unions organized outside of government control. |

Urban Growth | Average annual percentage change in urban population. |

Urban Population | Percentage of the population living in urban areas. |

War | Actual or potential armed conflict with another nation borne out of the desire of either combatant state to subjugate the governance of people and/or acquire territory of the other, primarily through the use of its own armed forces. |

Youth | Percentage of the population under 15 years of age. |

راهنمای متغیرهای PRS Group

The PRS Group Guide to Data Variables

Nonrepayable and nonrepaying payments by governments, plus government acquisition of claims on others (loans and equities), less repayments of lending and sales of equities previously purchased.Institutional strength and quality of the bureaucracy is a shock absorber that tends to minimize revisions of policy when governments change. In low-risk countries, the bureaucracy is somewhat autonomous from political pressure. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) Ranging from Very High Risk (00.0 – 49.5) to Very Low Risk (80.0 – 100). The higher the points, the lower the risk.A measure of corruption within the political system that is a threat to foreign investment by distorting the economic and financial environment, reducing the efficiency of government and business by enabling people to assume positions of power through patronage rather than ability, and introducing inherent instability into the political process. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)

icrg dataset free download

Total balance of payments on goods and services and all transfer payments: the difference between (a) exports of goods and services, plus inflows of unrequited official and private transfers, and (b) imports of goods and services, plus unrequited transfers to the rest of the world. Risk ratings for 18-month and five-year forecast periods, expressed both as alpha grades and as numerical scores, ranging from the least risk at A+ (<0.25) to the most risk at D- (>2.75). Also included are the previous alpha grades for both forecast periods. prior to 2000, to the DM). Risk ratings for 18-month and five-year forecast periods, expressed both as alpha grades and as numerical scores, ranging from the least risk at A+ (<0.25) to the most risk at D- (>2.75). Also included are the previous alpha grades for both forecast periods.

A measure of both the risk to the incumbent government from foreign action, ranging from non-violent external pressure (diplomatic pressures, withholding of aid, trade restrictions, territorial disputes, sanctions, etc) to violent external pressure (cross-border conflicts to all-out war). The risk rating assigned is the sum of three subcomponents: War, Cross-Border Conflict, and Foreign Pressures.(Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)

Download Data From PRS Group

To ensure comparability between countries, risk components are based on accepted ratios between the measured data within the national economic/financial structure, and then the ratios are compared, not the data. Risk points are assessed for each of the component factors of foreign debt as a percentage of GDP, foreign debt service as a percentage of exports of goods and services (XGS), current account as a percentage of XGS, net liquidity as months of import cover, and exchange rate stability. Risk ratings range from a high of 50 (least risk) to a low of 0 (highest risk), though lowest de facto ratings are generally near 20. The transfer could be for the payment of exports, repatriation of profits, capital or dividends. Risk ratings for 18-month and five-year forecast periods, expressed both as alpha grades and as numerical scores, ranging from the least risk at A+ (<0.25) to the most risk at D- (>2.75). Also included are the previous alpha grades for both forecast periods.

international country risk guide data xls

Commentary includes a discussion of policies and attitudes likely under the three alternative regime scenarios during the forecast period, and might also cover aid from other countries and from international financial institutions. Such pressures can range from diplomatic pressures, through suspension of aid and/or credits, to outright sanctions.Year-end value of foreign currency holdings (excluding gold) retained by the central bank for purposes of exchange intervention or settlement of intergovernmental claims.Nominal value of the total final output of goods and services produced within a country’s territorial jurisdiction, regardless of the foreign or domestic ownership of the source of the production.A measure of both of the government’s ability to carry out its declared program(s), and its ability to stay in office.

icrg data xls

The risk rating assigned is the sum of three subcomponents: Government Unity, Legislative Strength, and Popular Support.(Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)Annual net liquidity expressed as months of import cover and calculated as the official reserves of the individual countries, including their official gold reserves calculated at current free market prices, but excluding the use of IMF credits and the foreign liabilities of the monetary authorities.A measure of the factors affecting the risk to investment that are not covered by other political, economic and financial risk components. The risk rating assigned is the sum of three subcomponents: Contract Viability/Expropriation, Profits Repatriation, and Payment Delays. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)

international country risk guide free download

These elements might include such factors as protectionist sentiment, licensing requirements, quotas, restricted or banned goods, as well as underlying factors, such as lack of foreign currency, nationalistic motivations, and employment problems, that could act as barriers to trade. Risk ratings range from a high of 100 (least risk) to a low of 0 (highest risk), though lowest de facto ratings generally range in the 30s and 40s.A measure of religious tensions arising from the domination of society and/or governance by a single religious group — or a desire to dominate — in a way that replaces civil law by religious law, excludes other religions from the political/social processes, suppresses religious freedom or expressions of religious identity.

prs group political risk index

The risks involved range from inexperienced people imposing inappropriate policies to civil dissent or civil war. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)

The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)0.4 with 5.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.)10 with O.0 points. The higher the points, the lower the risk. (Refer to ICRG Methodology for maximum points for this variable, as well as for related formulas for calculating risk.) The fundamental difference between a terrorist campaign and a civil war is that the former do not hold and administer territory within a nation state. Takes into account violence from political groups or foreign governments operating within a country or from an external base, including riots, politically motivated strikes (but not including legal, non-violent strikes), demonstrations, terrorism, guerrilla activities, and civil or international war.

Table 2B Historical – Political, Economic, Financial & Composite Risk

Table 3B Historical – Political Risk Components

Table 3Ba Historical – Political Risk Subcomponents (since May 2001)

Table 4B Historical – Financial Risk Components

Table 5B Historical – Economic Risk Components

Table 7 Historical – GDP per Head of Population

Table 8 Historical – Real GDP Growth

Table 9 Historical – Inflation Rate

Table 10 Historical – Budget Balance (as a % of GDP),

Table 11 Historical – Current Account (as a % of GDP),

Table 12 Historical – Foreign Debt (as a % of GDP),

Table 13 Historical – Debt Service (as a % of XGS),

Table 14 Historical – Current Account (as a % of XGS),

Table 15 Historical – International Liquidity (Months of Import Cover),

Table 16 Historical – Exchange Rate Stability,

Table 17 Historical – Foreign Exchange Rates,

All ICRG Historical Data (includes all listed above except 3Ba and 17)

برخی از مقالاتی که از شاخصهای ICRG استفاده کرده اند :

1- بررسی تأثیر ساختارهای نهادی بر رشد اقتصادی با روش GMM دادههای تابلویی پویا

در مقاله از میانگین ساده هفت شاخص از شاخصهای ICRG در دوره 2009-1983 و نیز میانگین شش شاخص حکمرانی خوب در دوره 2009-1996 به عنوان شاخصهای نهادی برای بررسی در سطح جهانی و نمونه کشورهای مختلف استفاده شده است.

شاخص راهنمای ریسک بینالمللی کشورها

شاخص ICRG شامل رتبهبندی 22 متغیر در سه زیر گروه مختلف، ریسک سیاسی، ریسک مالی و ریسک اقتصادی است. در این مقاله از میانگین ساده هفت شاخص ثبات دولت، شرایط اجتماعی – اقتصادی، چشمانداز سرمایهگذاری، فساد، حاکمیت نظم و قانون، پاسخگویی دموکراتیک و کیفیت سیستم اداری، از میان دوازده شاخص ریسک سیاسی به عنوان شاخص نهادی استفاده میشود که یکی از دلایل استفاده از این شاخص، پوشش بسیار مناسب ابعاد مختلف نهادی توسط این شاخص هاست.

از آنجا که مقدار هر یک از این شاخصهای هفتگانه متفاوت است، برای یکسان نمودن وزن آنها، همه آنها را بین اعداد صفر و ده نرمال کرده و سپس با جمع آنها و میانگین گیری از این هفت شاخص (ICRG)، یک شاخص کلی نهادی برای آزمون تجربی ایجاد خواهد شد. بزرگتر بودن این شاخص به معنای وضعیت مناسبتر نهادی و پایینتر بودن مقدار آن وضعیت نامناسب نهادی را نشان میدهد. از دیگر حسنهای شاخصهای ICRG نسبت به اکثر شاخصهای دیگر آن است که آمارهای آن برای دوره زمانی نسبتاً طولانی مدتی (2008 – 1983) موجود است.

2- معرفی و نقد شاخص راهنمای بین المللی ریسک کشوری (ICRG)

برای دریافت رایگان فایل معرفی و نقد شاخص راهنمای بین المللی ریسک کشوری (ICRG) کلیک کنید.

به منظور اندازه گیری میزان ریسک سیاسی در کشورها ICRG شیوه های مختلفی وجود دارد که در این بین یکی از معتبرترین طبقه بندیها، مربوط به راهنمای بین المللی ریسک کشوری International Country Risk Guide است( راهنمای بین المللی ریسک کشوری ۲۲ متغیر را در سه زیر مقوله ریسک رتبه بندی می نماید ریسک سیاسی، ریسک مالی و ریسک اقتصادی که برای هر کدام زیر شاخص های جداگانه ای محاسبه می شود).

در روش شناسی ICRG شاخص ریسک سیاسی مبتنی بر ۱۰۰ امتیاز است و هر چقدر که امتیاز کشوری به عدد ۱۰۰ نیزدیکتر شود نشان از پایین بودن ریسک سیاسی در آن کشور است. مولفه های ریسک سیاسی به شرح جدول زیر می باشند؛ توالی و امتیاز هر مولفه نیز آورده شده است.

امارهای ICRG

گیگاپیپر به عنوان همکار پژوهشگران، تحلیل گران و برنامه ریزان ایرانی سعی دارد تمام داده ها و گزارشات مورد نیازتان را فراهم کند.

Produced monthly since 1980, ICRG has furnished an international clientele with ratings affecting political risk, economic risk and financial risk for its universe of 140 developed, emerging, and frontier markets. Forming the basis of an early warning system, over 30 metrics are used to assess these types of risk. The ICRG methodology is used consistently by researchers at the IMF, and has been acclaimed in such publications as Barron’s, The Economist, and The Wall Street Journal.

Among the added benefits of a subscription to ICRG are:

- The longest running data series for political risk and country risk analysis, globally;

- Data which is easy to customize and merge with in-house risk rating systems; and,

- Country risk data that includes Type-II forecasts over one- and five-year time horizons for added specificity in managing risk.

A few of our products based upon the ICRG methodology:

- International Country Risk Guide is published online, in print, and on CD-ROM. Each monthly issue monitors 140 countries and includes more than 100 pages of political, financial, and economic risk ratings. It offers analyses of events that affect the risk ratings in about 20-25 countries along with the economic and financial data underlying financial and economic risk ratings. The online and CD-ROM versions include the current issue and 12 months of previously published data. All subscribers to ICRG also receive a monthly edition of the Global Maps of Political Risk, pointing them to key changes in risk since the last issue.

- ICRG Data including current data published in the monthly ICRG issue and historical data (risk ratings and economic statistics) back to 1984, are available separately in digital formats, and on CountryData Online (CDO).

- Prepared ICRG Datasets offer average annual scores of selected ICRG risk ratings, giving academic researchers a more convenient and affordable way to purchase our risk scores.

- International Country Risk Guide Annual is a seven-volume set published annually, designed for university libraries, to provide cost effective access to ICRG’s coverage of 140 countries over the previous twelve months. For more information on this and related publications for academia, please go to Academic Titles.

خرید داده های ICRG

سه فایل Excel برای خرید داده های CountryData موجود است. لطفا با مطالعه توضیحات زیر ، بفرمایید کدام یک از سه فایل را نیاز دارید :

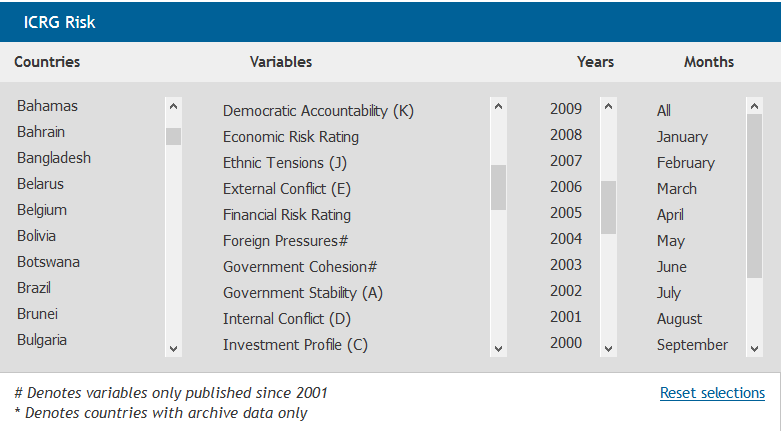

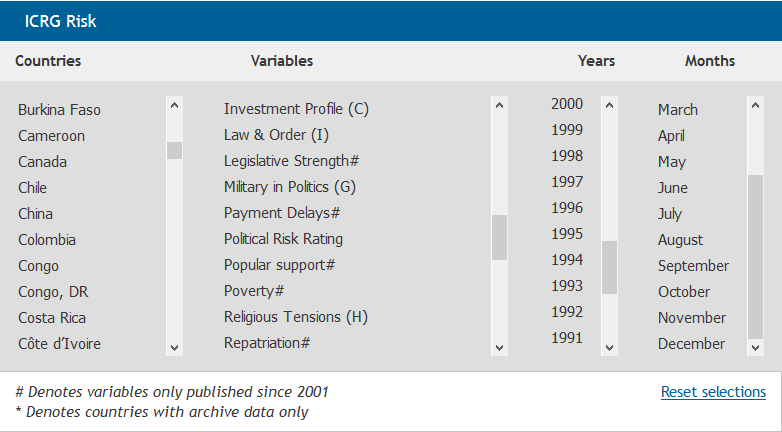

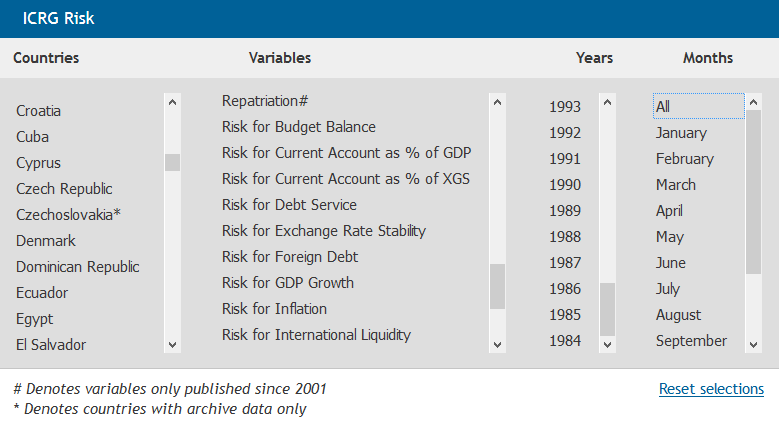

1- CountryData-ICRG Risk-All Country-All Variables-All Year-All Month-2018

کشورها :

کلیه داده های کشورهای زیر در فایل اکسل وجود دارد.

List of 140 countries monitored by International Country Risk Guide (ICRG)

| Albania Algeria Angola Argentina Armenia Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Belarus Belgium Bolivia Botswana Brazil Brunei Bulgaria Burkina Faso Cameroon Canada Chile China Colombia Congo Congo, DR Costa Rica Côte d’Ivoire | Croatia Cuba Cyprus Czech Republic Denmark Dominican Republic Ecuador Egypt El Salvador Estonia Ethiopia Finland France Gabon Gambia Germany Ghana Greece Guatemala Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong Hungary Iceland India | Indonesia Iran Iraq Ireland Israel Italy Jamaica Japan Jordan Kazakhstan Kenya Korea, DPR Korea, South Kuwait Latvia Lebanon Liberia Libya Lithuania Luxembourg Madagascar Malawi Malaysia Mali Malta Mexico Moldova Mongolia | Morocco Mozambique Myanmar Namibia Netherlands New Zealand Nicaragua Niger Nigeria Norway Oman Pakistan Panama Papua New Guinea Paraguay Peru Philippines Poland Portugal Qatar Romania Russia Saudi Arabia Senegal Serbia Sierra Leone Singapore Slovakia | Slovenia Somalia South Africa Spain Sri Lanka Sudan Suriname Sweden Switzerland Syria Taiwan Tanzania Thailand Togo Trinidad & Tobago Tunisia Turkey UAE Uganda Ukraine United Kingdom United States Uruguay Venezuela Vietnam Yemen Zambia Zimbabwe |

آلبانی الجزایر آنگولا آرژانتین ارمنستان استرالیا اتریش جمهوری آذربایجان باهاما بحرین بنگلادش بلغارستان بلغارستان بولیوی بوتسوانا برزیل برونئی بلغارستان بورکینافاسو کامرون کانادا شیلی چین کلمبیا کنگو کرواسی کوبا قبرس جمهوری چک جمهوری چک جمهوری دموکراتیک جمهوری دومینیکن شرق آلمان اکوادور مصر السالوادور استونی اتیوپی فنلاند فرانسه گابن گامبیا آلمان غنا یونان گواتمالا گینه گینه بیسائو گویان هائیتی هندوراس هنگ کنگ مجارستان ایسلند هند.

اندونزی ایران عراق ایرلند اسرائیل ایتالیا جامائیکا ژاپن اردن قزاقستان کنیا کره شمالی DPR کویت لتونی لبنان لیبریا لیبی لیتوانی لوکزامبورگ ماداگاسکار مالاوی مالزی مالزی مالت مکزیک مولدووا مغولستان مراکش موزامبیک میانمار نامیبیا هلند کالدونیای جدید نیوزیلند نیکاراگوئه نیجر نیجریه نروژ عمان پاکستان پاناما پاپوآ گینه نو پاراگوئه پرو فیلیپین لهستان پرتغال قطر رومانی روسیه عربستان سعودی سنگال صربستان صربستان و مونته نگرو سیرالئون سنگاپور اسلو .akia اسلوونی سومالی آفریقای جنوبی کره جنوبی اسپانیا سری لانکا سودان سورینام سوئد سوئیس سوریه تایوان تانزانیا تایلند تگو ترینیداد و توباگو تونس ترکیه امارات متحده عربی اوگاندا اوکراین بریتانیا ایالات متحده اروگوئه اتحاد جماهیر شوروی ونزوئلا ویتنام آلمان غرب یمن زامبیا زیمبابوه

متغیرهای ICRG

Variable

Bureaucracy Quality (L)

Civil Disorder

Civil War

Composite Risk Rating

Consumer Confidence

Contract Viability

Corruption (F)

Cross-border Conflict

Democratic Accountability (K)

Economic Risk Rating

Ethnic Tensions (J)

External Conflict (E)

Financial Risk Rating

Foreign Pressures

Government Cohesion

Government Stability (A)

Internal Conflict (D)

Investment Profile (C)

Law & Order (I)

Legislative Strength

Military in Politics (G)

Payment Delays

Political Risk Rating

Popular support

Poverty

Religious Tensions (H)

Repatriation

Risk for Budget Balance

Risk for Current Account as % of GDP

Risk for Current Account as % of XGS

Risk for Debt Service

Risk for Exchange Rate Stability

Risk for Foreign Debt

Risk for GDP Growth

Risk for Inflation

Risk for International Liquidity

Risk for Per Capita GDP

Socioeconomic Conditions (B)

Terrorism

Unemployment

War

سال های موجود :

داده ها از 1984 تا سال 2022 (در زمان نوشتن این متن تا اولین ماه 2022) موجود است.

1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

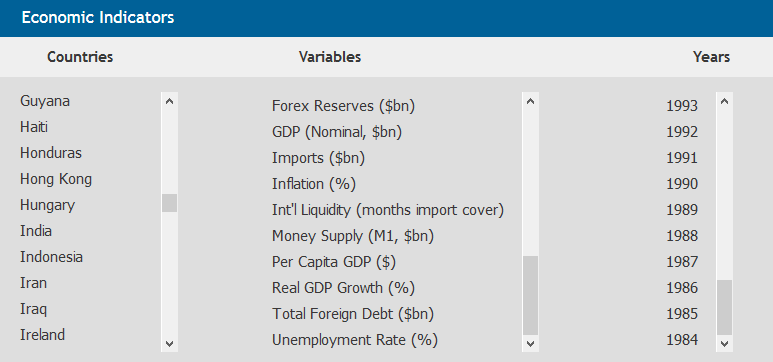

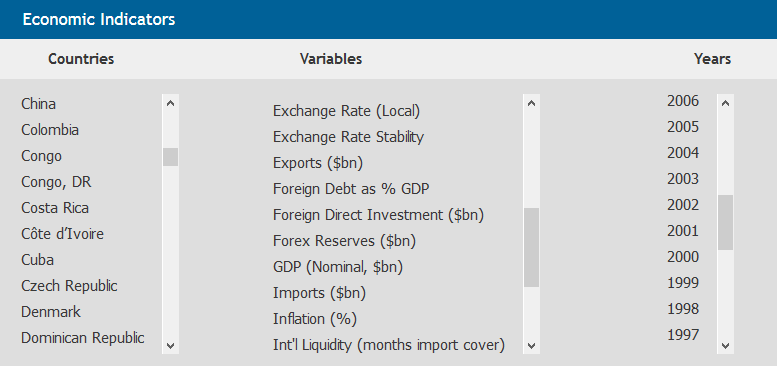

2- CountryData-Economic Indicators-All Country-All Variables-All Year

داده های Economic Indicators شامل کلیه کشورهای لیست شده در بالا ، و از تاریخ 1984 تا اخر 2021 و شامل متغیرهای زیر می باشد.

متغیرها

| Budget Balance as % of GDP |

| Budget Expenses ($bn) |

| Budget Revenues ($bn) |

| Capital Investment ($bn) |

| Change in Real Wages (%) |

| Current Account ($bn) |

| Current Account as % of GDP |

| Current Account as % of XGS |

| Debt Service as % of XGS |

| Exchange Rate (Local) |

| Exchange Rate Stability |

| Exports ($bn) |

| Foreign Debt as % GDP |

| Foreign Direct Investment ($bn) |

| Forex Reserves ($bn) |

| GDP (Nominal, $bn) |

| Imports ($bn) |

| Inflation (%) |

| Int’l Liquidity (months import cover) |

| Money Supply (M1, $bn) |

| Per Capita GDP ($) |

| Real GDP Growth (%) |

| Total Foreign Debt ($bn) |

| Unemployment Rate (%) |

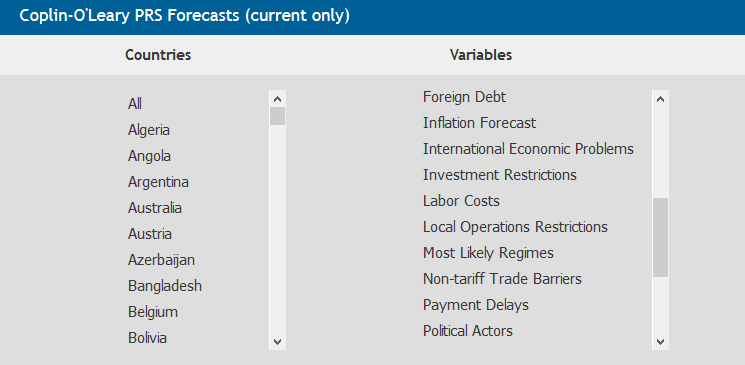

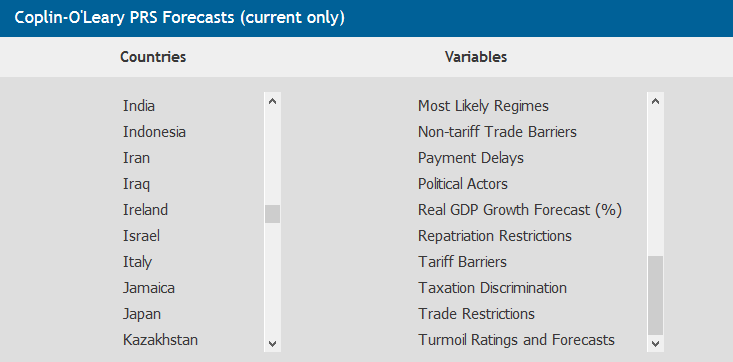

3- CountryData-Coplin-O’Leary PRS Forecasts (current only)-All Countries-All Variables

این داده ها در FEB 30 سال 2020 دریافت شده و مربوط به سال 2019 می باشد. و شامل متغیرهای زیر

| Current Account Forecast |

| Real GDP Growth Forecast (%) |

| Inflation Forecast |

| Direct Investment Risk |

| Export Market Risk |

| Financial Transfer Risk |

| Domestic Economic Problems |

| Equity Restrictions |

| Fiscal/Monetary Expansion |

| Foreign Debt |

| International Economic Problems |

| Labor Costs |

| Non-tariff Trade Barriers |

| Payment Delays |

| Most Likely Regimes |

| Repatriation Restrictions |

| Tariff Barriers |

| Taxation Discrimination |

| Exchange Controls |

| Local Operations Restrictions |

| Turmoil Ratings and Forecasts |

| Investment Restrictions |

| Trade Restrictions |

| Political Actors |